b&o tax credit

Business Occupation BO Tax Credits. Full-Time Employees For a full-time.

Apple Iphone 6 16gb Gsm Unlocked Space Gray Used Ting Sim Card 30 Credit

Ad No Money To Pay IRS Back Tax.

. You can get a 500 BO tax credit every year for five years if you. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

Read customer reviews find best sellers. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Business who will be.

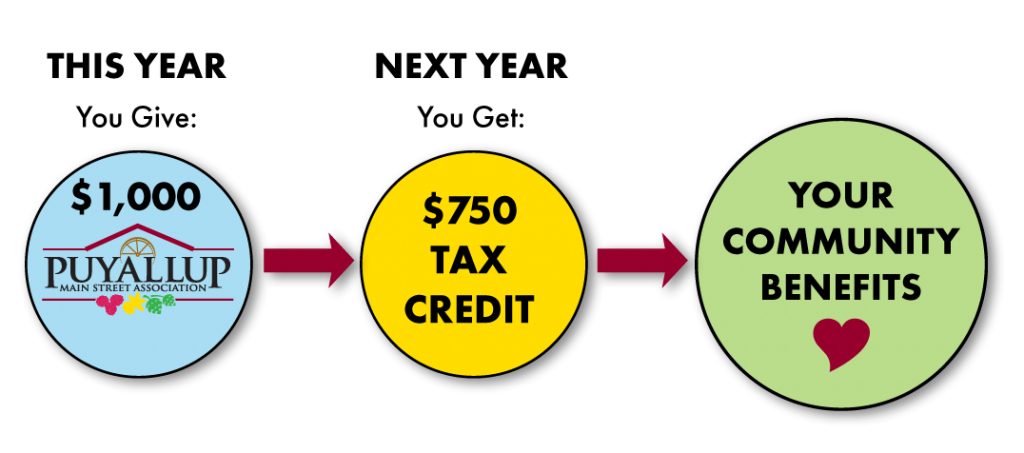

There are two credits available under the Small Business Tax Credit depending on your taxable income and total BO tax liability. The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility Tax PUT credit for private contributions given to eligible downtown organizations. Add a new full-time 35 or more hoursweek job to your Tacoma.

The Small Business Tax Credit 720 applies if. Ad Compare 1000s Of Ratings On Tax Companies Online. 500 Base Credit - Qualifying Position.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Puyallup Main Street Association.

You can make the donation by sending a check to the following address. The Washington State Main Street BO Tax Credit Incentive Program allows businesses to make a donation to the. The credit is taken against the BO tax for each new employment position filled and maintained by qualified businesses located in eligible areas.

In 2020 when you go to pay your BO. Compare 1000s Of Ratings In One Place. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5 of the tax for the first month or.

Ad Browse discover thousands of brands. Free easy returns on millions of items. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO. If the check amount field for your school district is Not eligible.

The Employee Retention Tax Credit ERTC also referred to as the ERC credit was made. Ad No Money To Pay IRS Back Tax. An ordinance of the Council of the City of Fairmont enacted in part pursuant to the provisions of West Virginia Code Section 8-1-5a Municipal.

Most businesses have been assigned an annual reporting status for the 2022 tax year. Learn More At AARP. Washington State BO Tax Guidelines for ERC Credit and COVID Relief.

The Main Street BO Tax Credit Incentive Program is open for 2022. Free shipping on qualified orders. The 2021 filing is not due and the BO tax return does not need to be filed.

New BO Tax Credit.

B O Tax Credit Program Sumner Main Street Association

Main Street Tax Credit Program In Washington

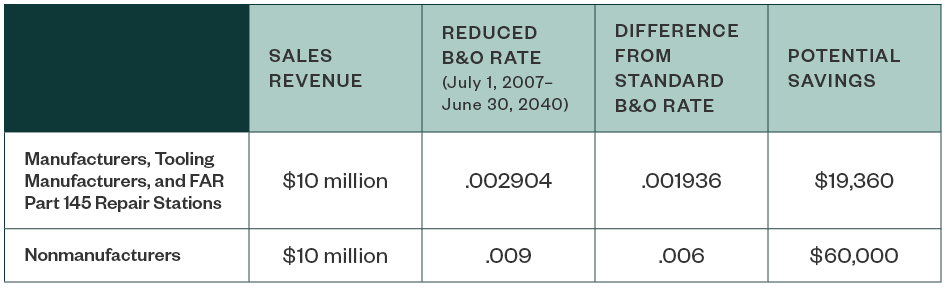

Washington Aerospace Tax Incentives

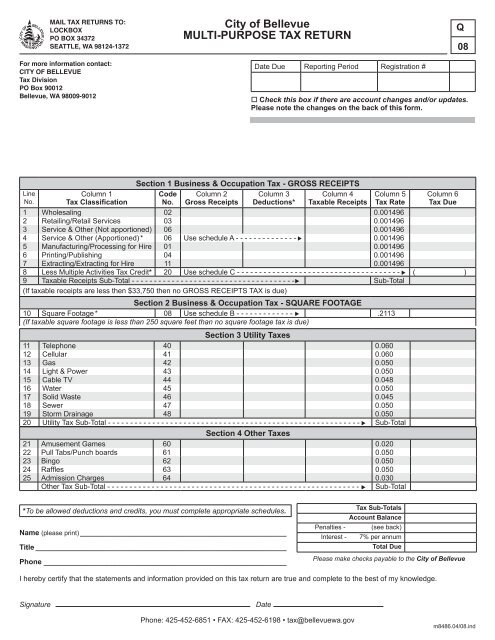

Quarterly Multi Purpose Tax Return City Of Bellevue

B O Tax Program Puyallup Main Street Association

Form Rev41 0077 Download Fillable Pdf Or Fill Online Rural Area Application For New Employee B O Tax Credit Washington Templateroller

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Business And Occupation B O Tax Washington State And City Of Bellingham